국가미래연구원은 폭 넓은 주제를 깊은 통찰력으로 다룹니다

※ 여기에 실린 글은 필자 개인의 의견이며 국가미래연구원(IFS)의 공식입장과는 차이가 있을 수 있습니다.

[Fed Watch] 장기물을 제외하고 전반적인 수익률 하락세 - 2020.1.6 본문듣기

작성시간

- 기사입력 2020년01월06일 17시00분

- 최종수정 2020년01월06일 11시58분

관련링크

본문

<1> 금주 T-Bill 수익률과 Yield Curve : 단기 및 중기물 수익률 하락

■ 미국 국채수익률은 전반적으로 하락세 시현

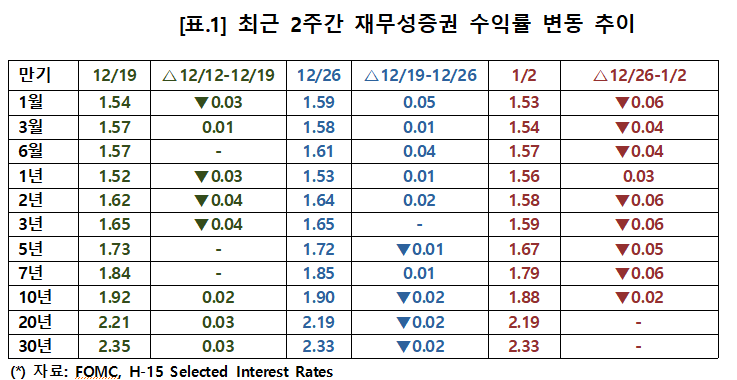

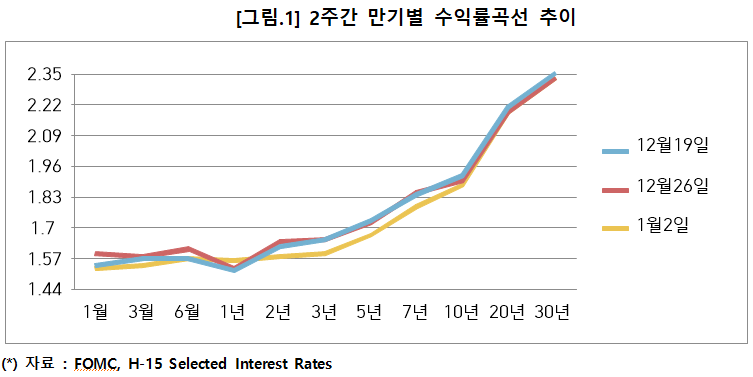

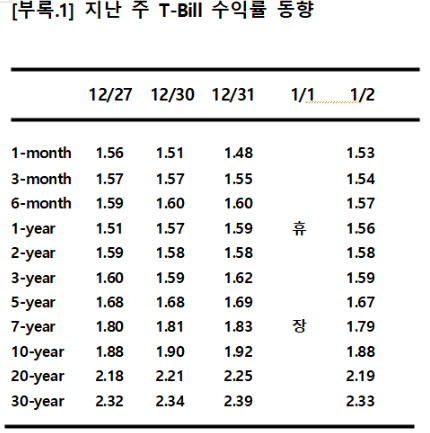

- 최근 2주간 재무성증권 수익률 변동 추이

- 1년 물 수익률은 3bp 상승, 그 외 모두 수익률 하락

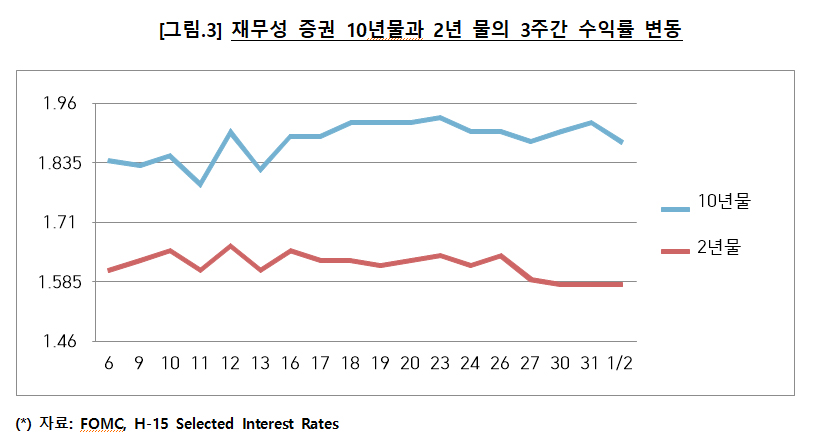

■ 10년 물 수익률은 상승세 멈추고 소폭 하락세로 반전한 반면

- 10년 물과 2년 물 격차가 30bp로 소폭 확대됨.

<2> 연준-FOMC의 2019년 12월 10일-11일 회의 의사록

(2019년 1월 3일 동부시간 오후 2시 공개)(2019년 1월 3일 동부시간 오후 2시 공개)

■ Committee Policy Action

In their discussion of monetary policy for this meeting, members noted that information received since the FOMC met in October indicated that the labor market remained strong and that economic activity had been rising at a moderate rate. Job gains had been solid, on average, in recent months, and the unemployment rate had remained low. Although household spending had been rising at a strong pace, business fixed investment and exports remained weak. On a 12‑month basis, overall inflation and inflation for items other than food and energy were running below 2 percent. Market-based measures of inflation compensation remained low; survey-based measures of longer-term inflation expectations were little changed.

Members agreed to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent. Members judged that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective.

Members also agreed that, in determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee would assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. And they concurred that this assessment would take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

With regard to the postmeeting statement, members agreed to state that they judged that "the current stance of monetary policy is appropriate" to support the achievement of the Committee's policy objectives. Members discussed their options regarding references to global developments and muted inflation pressures in the statement. In their judgment, these factors, cited in previous postmeeting statements as part of the rationale for adjusting the stance of policy, remained salient features of the outlook. Accordingly, they agreed to cite them in the sentence indicating that "the Committee will continue to monitor the implications of incoming information for the economic outlook." With the retention of these references to global developments and muted inflation pressures, members agreed that the text on uncertainties about the outlook could be removed. A few members suggested that the language stating that monetary policy would support inflation "near" 2 percent could be misinterpreted as suggesting that policymakers were comfortable with inflation running below that level; they preferred language that referred to returning inflation to the Committee's symmetric 2 percent objective. Other members thought that the reference to "near" 2 percent was intended to encompass modest deviations of inflation above and below 2 percent.

At the conclusion of the discussion, the Committee voted to authorize and direct the Federal Reserve Bank of New York, until instructed otherwise, to execute transactions in the SOMA in accordance with the following domestic policy directive, to be released at 2:00 p.m.:

<보도자료>

"Effective December 12, 2019, the Federal Open Market Committee directs the Desk to undertake open market operations as necessary to maintain the federal funds rate in a target range of 1-1/2 to 1-3/4 percent.

In light of recent and expected increases in the Federal Reserve's non-reserve liabilities, the Committee directs the Desk to continue purchasing Treasury bills at least into the second quarter of 2020 to maintain over time ample reserve balances at or above the level that prevailed in early September 2019.

The Committee also directs the Desk to continue conducting term and overnight repurchase agreement operations at least through January 2020 to ensure that the supply of reserves remains ample even during periods of sharp increases in non-reserve liabilities, and to mitigate the risk of money market pressures that could adversely affect policy implementation.

In addition, the Committee directs the Desk to conduct overnight reverse repurchase operations (and reverse repurchase operations with maturities of more than one day when necessary to accommodate weekend, holiday, or similar trading conventions) at an offering rate of 1.45 percent, in amounts limited only by the value of Treasury securities held outright in the System Open Market Account that are available for such operations and by a per-counterparty limit of $30 billion per day.

The Committee directs the Desk to continue rolling over at auction all principal payments from the Federal Reserve's holdings of Treasury securities and to continue reinvesting all principal payments from the Federal Reserve's holdings of agency debt and agency mortgage-backed securities received during each calendar month. Principal payments from agency debt and agency mortgage-backed securities up to $20 billion per month will continue to be reinvested in Treasury securities to roughly match the maturity composition of Treasury securities outstanding; principal payments in excess of $20 billion per month will continue to be reinvested in agency mortgage-backed securities. Small deviations from these amounts for operational reasons are acceptable.

The Committee also directs the Desk to engage in dollar roll and coupon swap transactions as necessary to facilitate settlement of the Federal Reserve's agency mortgage-backed securities transactions."

The vote also encompassed approval of the statement below to be released at 2:00 p.m.:

"Information received since the Federal Open Market Committee met in October indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong pace, business fixed investment and exports remain weak. On a 12‑month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee decided to maintain the target range for the federal funds rate at 1-1/2 to 1-3/4 percent. The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective. The Committee will continue to monitor the implications of incoming information for the economic outlook, including global developments and muted inflation pressures, as it assesses the appropriate path of the target range for the federal funds rate.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments."

■ Voting for the FOMC monetary policy action were(만장일치):

Jerome H. Powell, Chairman; John C. Williams, Vice Chairman;

Michelle W. Bowman; Lael Brainard; James Bullard; Richard H. Clarida;

Charles L. Evans; Esther L. George; Randal K. Quarles; and Eric S. Rosengren.

- 기사입력 2020년01월06일 17시00분

- 최종수정 2020년01월06일 11시58분

댓글목록

등록된 댓글이 없습니다.